Protein A Resins Market Size Worth USD 2.73 Billion By 2034

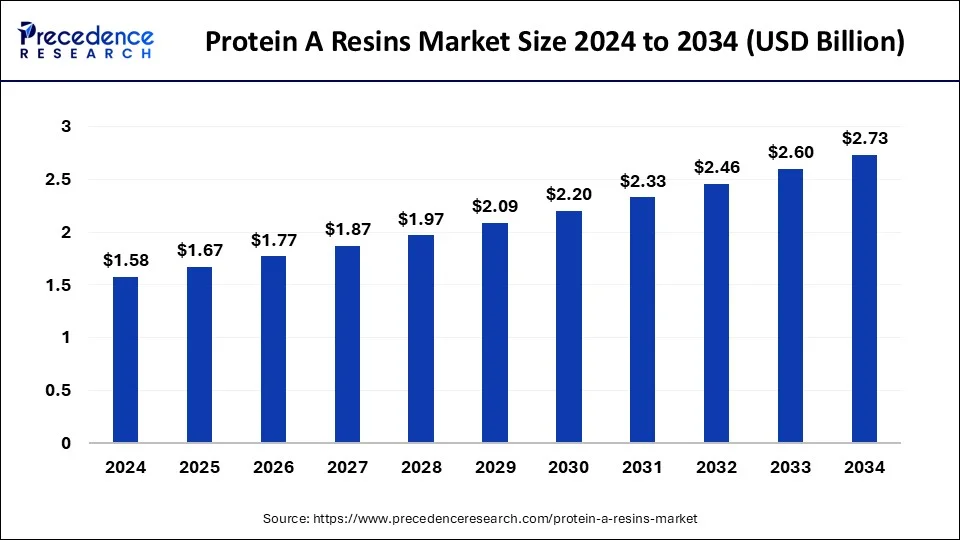

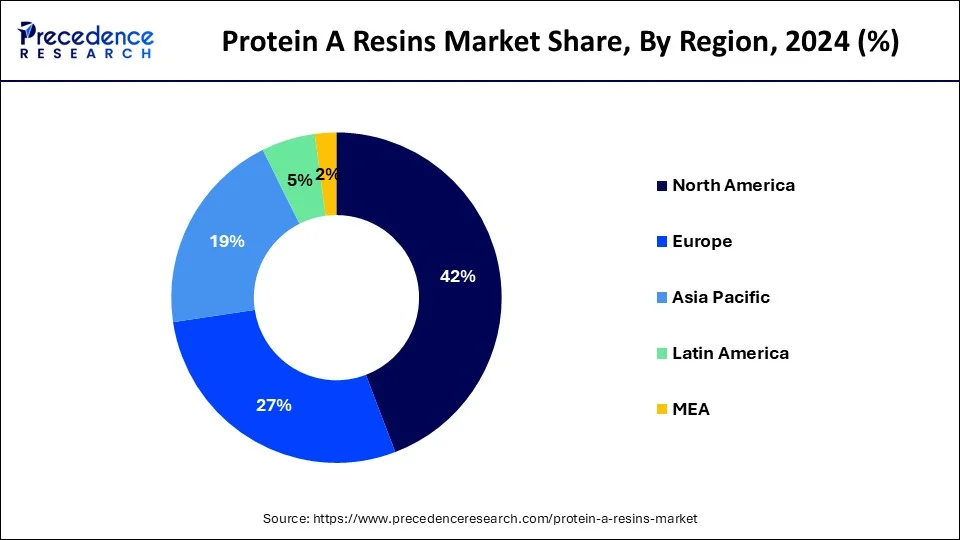

The global protein A resins market size is expected to be worth USD 2.73 billion by 2034, increasing from USD 1.67 billion in 2025, growing at a CAGR of 5.62% from 2025 to 2034. North America dominated the global market with a 42% share in 2024, while Asia Pacific is projected to record the fastest growth during the forecast period.

Ottawa, Oct. 20, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global protein A resins market size will grow from USD 1.67 billion in 2025 to nearly USD 2.73 billion by 2034, with an expected CAGR of 5.62% from 2025 to 2034. Development in developed regions, drug discovery, detection of additives in food, and an increase in the use of chromatographic techniques to determine vitamins are driving the growth of the market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4063

Protein A Resins Market Highlights

- The global protein A resins market size was valued at USD 1.58 billion in 2024.

- North America held the major market share of 42% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

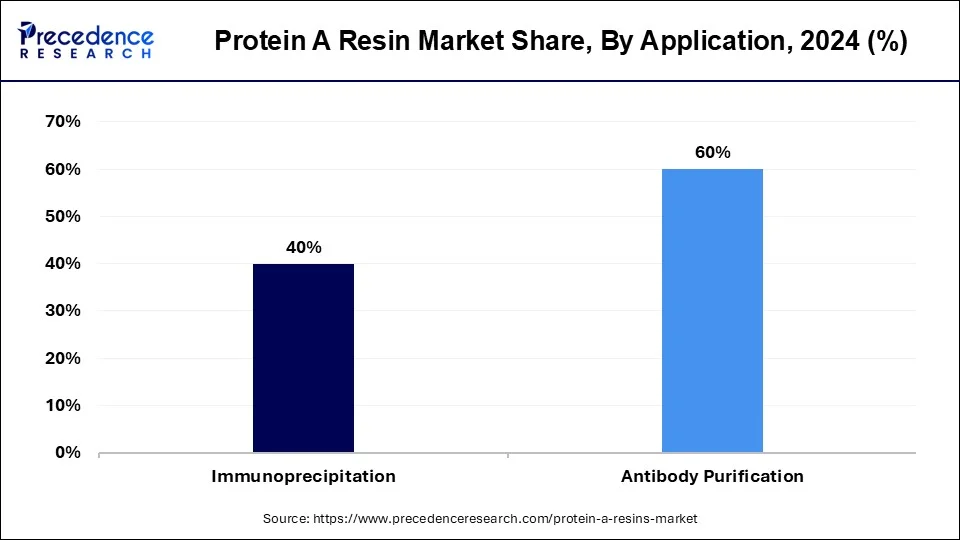

- By application, the antibody purification segment generated the largest market share of 60% in 2024.

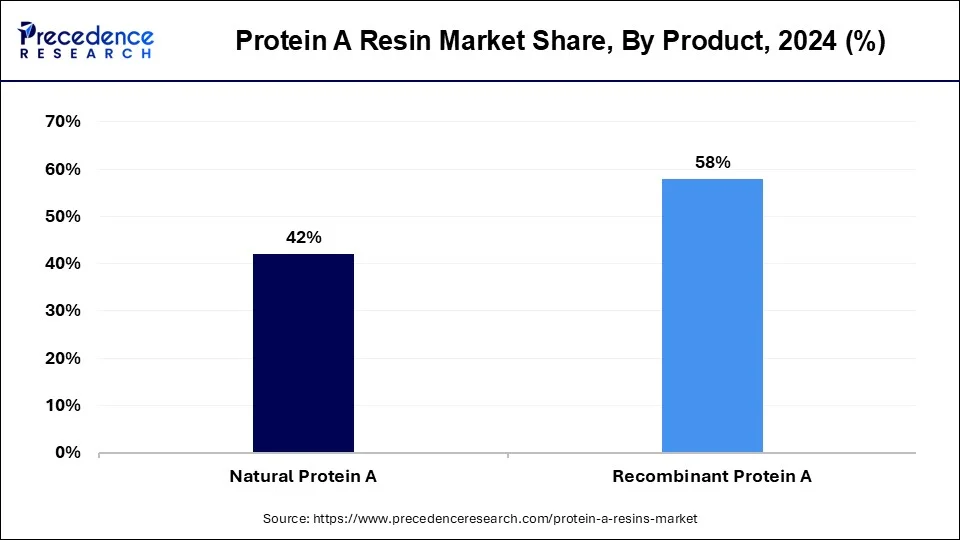

- By product, the recombinant protein A segment contributed the biggest market share of 58% in 2024.

- By matrix type, the agarose-based matrix segment held a major market share of 42.3% in 2024.

- By end-user, the pharmaceutical & biopharmaceutical companies segment has held the largest market share of 59% in 2024.

What are the Protein A Resins?

The protein A resins market encompasses the production, distribution, and application of protein A resins, which serve as chromatography media for purifying a range of antibodies and monoclonal antibody products. Protein A resin is used in a range of life sciences laboratories, including biochemistry, biophysics, and immunology labs, for assays requiring the purification of various antibodies and antibody products. Protein A is useful for the study of antigens and receptors on the surface of intact cells, and for the detection of antibody-secreting cells.

The recombinant protein A ligand is coupled to 4% agarose. The coupling is improved to give high binding capacity for immunoglobulins. The static binding capacity of protein A resin is greater than 20 mg human IgG/ml settled resin. The protein A step is ubiquitous in its presence in purification platforms for the production of antibody products due to the effective clearance it offers of impurities, high and low molecular weight species (HMW and LMW), host cell proteins (HCP), and DNA.

Major Government Initiatives for Protein A Resins:

-

SBIR Grant (USA): “Chromatography-Free Antibody Purification” - U.S. government-funded project using Protein A-derived ligands in a novel, non-chromatographic purification method to reduce costs and improve scalability.

-

NIH Common Fund: Protein Capture Reagents Program (USA) - Aimed at developing high-quality, renewable affinity reagents (like Protein A alternatives) to improve protein purification tools for research and diagnostics.

-

Good Food Institute Grant: “Low-Cost Protein Purification” - Public funding supported research into new bioprocessing methods that may reduce reliance on expensive Protein A resin purification steps in precision fermentation.

-

Canadian Government Investment in Antibody Manufacturing (Canada & British Columbia) - Funded infrastructure expansion for biologics manufacturing, indirectly supporting increased demand for Protein A resins used in antibody purification.

-

Public Research Grant: Biocatalytic Production of Affinity Resins (Japan) - Government-supported research developed a Protein A-based affinity resin using enzymatic immobilization, showing improved durability and NaOH resistance.

What are the Key Trends of the Protein A Resins Market?

-

Greater Demand Driven by Monoclonal Antibodies & Biosimilars: The rising production of monoclonal antibodies (mAbs), antibody-drug conjugates (ADCs), and biosimilars is significantly increasing the demand for Protein A resins, as they are critical for antibody purification processes.

-

Improvement in Resin Performance (Capacity, Stability, Reusability): Manufacturers are developing advanced Protein A resins with higher binding capacities, greater chemical and alkali stability, and improved reusability, aiming to reduce the overall cost per purification cycle.

-

Shift Toward Single-Use Formats & Pre-Packed Columns: There is a growing trend toward using single-use systems and pre-packed chromatography columns, which offer operational flexibility, reduce cross-contamination risks, and simplify validation in manufacturing environments.

-

Sustainability & Cost-Effectiveness Pressures: With increased focus on sustainability and cost-efficiency, the market is seeing innovations in resin materials and production methods to reduce waste, improve recyclability, and lower operational costs.

-

Regional Growth in Asia-Pacific & Increased Outsourcing (CMOs/CDMOs): The Asia-Pacific region is emerging as a high-growth market due to expanding biopharmaceutical infrastructure, while the increasing reliance on contract manufacturing and development organizations (CMOs/CDMOs) is driving consistent demand for scalable Protein A resin solutions.

View Detailed Insight@ https://www.precedenceresearch.com/protein-a-resins-market

Protein A Resins Market Opportunity

Recombinant Protein Development

Recombinant protein development will provide an opportunity for the protein A resins market. Recombinant protein production is a mature biotechnological process for the large-scale production of specific proteins of interest. Generally, recombinant protein production is achieved through the manipulation of gene expression in an organism by fusing sequences of foreign DNA into a host cell. The recombinant proteins are safe compared to proteins obtained from natural sources. When scientists use recombinant technology, they can tightly control the production process to reduce the chance of impurities, pathogens, or toxins contaminating the final product.

Recombinant proteins are proteins encoded by recombinant DNA that has been cloned into an expression vector that supports expression of the gene and translation of messenger RNA. Modification of the gene by recombinant DNA technology can lead to the expression of a mutant protein. Recombinant proteins also demonstrate significant potential for clinical applications like therapeutic proteins, vaccines, and diagnostic reagents.

Protein A Resins Market Challenges

Complex Supply Chain

Complex supply chain dynamics with potential disruptions can limit the protein A resins market. To reduce the inherent risk of reliance on a single vendor for this critical material and mitigate potential interruption of the drug substance, as well as potential risks that can compromise drug substance comparability when using a second-source protein A resin.

Disruptions in the supply chain, like production issues, raw material shortages, and transportation delays, can impact the availability of protein A resin in the market. This may occur due to a shortage of components, raw materials, other critical inputs, logistical issues, natural disasters, pandemics, machinery breakdown, or fire, leading to decreased output and potential stockouts.

Scope of Protein A Resins Market

| Report Coverage | Details | |

| Market Size in 2025 | USD 1.67 Billion | |

| Market Size in 2026 | USD 1.77 Billion | |

| Market Size by 2034 | USD 2.73 Billion | |

| CAGR from 2025 to 2034 | 5.62% | |

| Largest Market | North America | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Application, Product, Matrix Type, End-user, and Region | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

How North America Dominated the Protein A Resins Market?

North America dominated the global protein resins market in 2024 with a share of 42%, due to the shift towards single-use technologies, technological benefits, increased investment in R&D activities and biopharmaceutical manufacturing capacities, commercialization of biosimilars, which is creating higher demand for high-volume and efficient purification processes, and increasing monoclonal antibodies (mAbs) demand in the biopharmaceutical sector in the region. The strong biopharmaceutical industry and robust R&D investments are fueling the market growth. Additionally, the growing emphasis on manufacturers toward the development of monoclonal antibodies and biosimilars is fostering this growth. North America has a well-established environment of contract manufacturing organizations (CROs), making the supply chain and distribution of protein A resins more accessible and affordable.

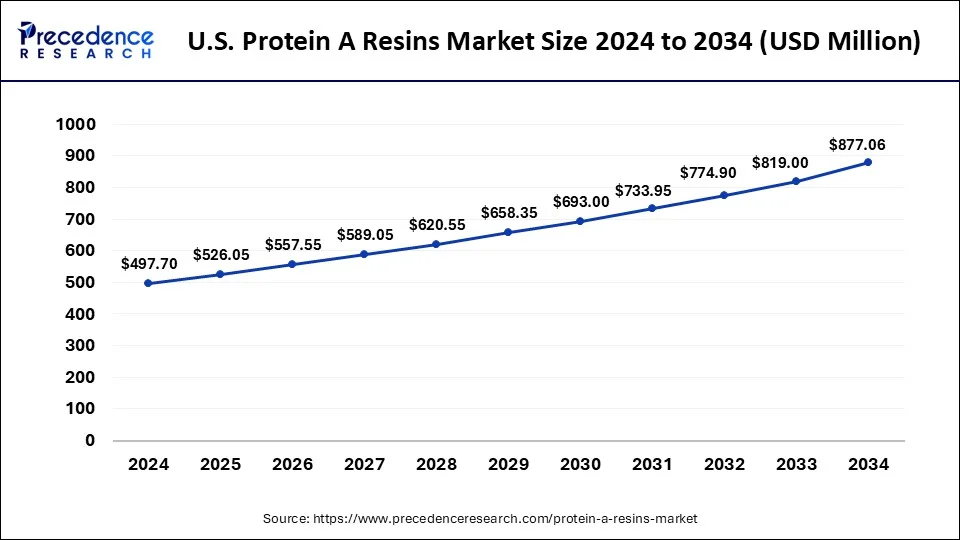

The U.S. is a major player in the regional market due to its robust biopharmaceutical industry, which includes many leading monoclonal antibody developers and manufacturers. With advanced bioprocessing infrastructure and significant public and private investment in life sciences research, the U.S. has a strong demand for high-quality purification technologies like Protein A resins. Additionally, the presence of major global resin suppliers operating in the U.S. and regulatory support for biologics and biosimilars further reinforces the country's leadership in this market.

What is the U.S. Protein A Resins Market Size?

The U.S. protein A resins market accounted for USD 526.05 million in 2025 and is predicted to increase from USD 557.55 million in 2026 to approximately USD 877.06 million by 2034, expanding at a CAGR of 5.83% from 2025 to 2034.

Why is the Asia Pacific the fastest-growing region in the Protein A Resins Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period because of the integration of automated and integrated systems, agarose-based resins, continuous technological benefits in chromatography and resin development, growing R&D investments, expansion of the biopharmaceutical & biosimilar industries, rising demand for high-purity monoclonal antibodies (mAbs) for chronic disease treatments, and the dominance of antibody purification in the region.

The expanding biopharmaceutical manufacturing capabilities in Asia are fueling the manufacturing of antibodies. The governments of Asian companies like China, India, Japan, and South Korea are investing heavily in biotechnology infrastructure, contributing to the market growth.

Country-Level Investments and Funding in the Protein A Resins Industry:

-

China - The Chinese government has included biopharmaceuticals, including monoclonal antibodies, as a strategic priority in its national development plans. Large-scale investments in domestic bioproduction have indirectly boosted demand and support for downstream processing technologies like Protein A resins.

-

India - India’s government has launched initiatives under programs like “Make in India” and national biotech funding schemes that support R&D and manufacturing in biosimilars and biologics. These initiatives create infrastructure and incentives that promote the use and local production of Protein A purification technologies.

-

Germany / European Union - EU-wide funding programs such as Horizon Europe and other life sciences R&D frameworks have invested heavily in bioprocessing and therapeutic antibody development. While not Protein A-specific, these programs indirectly fund the development and adoption of advanced Protein A resins as part of antibody manufacturing workflows.

-

United States - The U.S. government, through agencies like NIH and BARDA, has consistently funded monoclonal antibody research and biologics manufacturing infrastructure. These investments support the entire production chain, including purification processes that rely on Protein A resins.

-

Canada - The Canadian federal and provincial governments have invested in biomanufacturing capacity, especially following the COVID-19 pandemic. These funds support facilities that produce therapeutic antibodies and vaccines, driving procurement and use of Protein A resins in purification processes.

Market Segmentation

Application Insights

Which Application Segment Dominated the Protein A Resins Market in 2024?

The antibody purification segment dominated the market in 2024 with a share of 60%. Antibody production is a main function of the immune system and is carried out by B cells. Antibodies can act as an important part of the immune response by specifically recognizing and binding to particular antigens, like bacteria or viruses, and aiding in their destruction.

Purification of antibodies is thus essential to ensure their efficacy, safety, and regulatory compliance. This technique offers benefits like high purity and recovery yield, allowing one-step purification to obtain antibody products with over 95% purity through optimization of buffer conditions and elution parameters.

The immunoprecipitation segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Immunoprecipitation (IP) is a technique used to isolate a protein from a cellular extract. The protein of interest (POI) is recognized by a specific antibody (Ab) conjugated to beads. Immunoprecipitation (IP) is ideal for the small-scale enrichment of proteins. It is fast and relatively easy in comparison to affinity chromatography, which is time-consuming and involves cycles of binding and washing. Immunoprecipitation (IP) is a protein purification method that allows us to isolate a specific protein from a mixture of proteins using antigen-antibody interactions, where the specific protein being isolated may be referred to as the target antigen.

Product Insights

Which Product Segment Leads the Protein A Resins Market?

The recombinant protein A segment led the market with a share of 58% in 2024. Recombinant proteins reduce the risk of contamination from pathogens that may be present in natural sources. Recombinant proteins can be produced at scale, making them cost-effective as compared to extracting proteins from natural sources. Recombinant proteins are produced under controlled laboratory conditions, ensuring high purity and consistency in structure and function.

The natural protein A segment is projected to experience the highest growth rate in the market between 2025 and 2034. The benefits of protein A include slowing down the aging process, lowers our blood pressure, enzymatic reactions, improved muscle recovery, energy production, boosting calorie burning, balances fluids, improving brain function, cardiovascular health, blood sugar regulation, assisting body metabolism, accelerating recovery after injury, makes skin healthy, hormonal regulation, assisting body metabolism, accelerating recovery after injury, makes skin healthy, hormonal regulation, bone health, and more.

Matrix Type Insights

How Agarose-based Matrix Leads the Protein A Resins Market in 2024?

The agarose-based matrix segment led the market in 2024 with a share of 42.3%. Agarose-based matrix have been used for protein purification for decades, and a broad variety of agarose-based matrices is commercially available. Agarose-based matrix is therefore responsible for the separation of DNA by size during electrophoresis, and several models exist to explain the mechanism of separation of biomolecules in gel matrix. In agarose gels, larger DNA fragments move more slowly through the matrix due to physical hindrance, whereas smaller fragments navigate the pores more easily. Agarose is a natural polysaccharide that is commonly used in the form of a hydrogel.

The organic polymer-based matrix segment is expected to grow at the fastest rate of market growth from 2025 to 2034. The polymer matrix is mainly popular for its stiffness, high strength, lightweight, corrosion resistance, abrasion resistance, and feasibility. Organic polymer is most notably used as a material for crafting the Ghillie Suit, which allows for improved survival in the heat and reduces visibility against creatures.

End-user Insights

Which End-user Segment Dominates the Protein A Resins Market?

The pharmaceutical and biopharmaceutical companies segment dominated the market in 2024 with a share of 59% and is anticipated to grow with the highest CAGR in the market during the studied years. In pharmaceutical and biopharmaceutical companies, protein A resins are used extensively in the large-scale production of mAb-based drugs for autoimmune diseases and cancer.

Protein A resin is used in a range of life sciences labs. Pharmaceutical applications of resins include the extraction and purification of enzymes, antibiotics, viruses, alkaloids, hormones, and the treatment of fermentation products.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Top Companies in the Protein A Resins Market

-

Novasep Holdings SAS - offers a range of chromatography solutions, including high-performance Protein A resins tailored for monoclonal antibody purification.

-

Abcam PLC - provides Protein A affinity chromatography products designed to facilitate efficient antibody capture and purification in research and diagnostic applications.

-

Bio-Rad Laboratories, Inc. - delivers Protein A resins known for their high binding capacity and scalability, catering to both process development and large-scale biomanufacturing.

-

Thermo Fisher Scientific Inc. - offers a comprehensive portfolio of Protein A chromatography resins optimized for rapid, high-purity antibody purification in bioprocess workflows.

-

Repligen Corp. - specializes in high-capacity, next-generation Protein A affinity resins engineered for improved performance and cost-efficiency in bioproduction.

-

Agilent Technologies - provides Protein A resins as part of its bioprocessing tools, enabling consistent and reproducible purification of monoclonal antibodies.

-

GenScript Biotech Corp. - supplies customizable Protein A resins tailored for laboratory and industrial-scale antibody purification, emphasizing flexibility and high recovery rates.

-

PerkinElmer, Inc. - offers Protein A affinity media within its suite of bioprocessing products, supporting high-throughput purification needs in biologics development.

-

Merck Millipore (a division of Merck KGaA) - delivers advanced Protein A chromatography resins such as the Eshmuno® A series, designed for superior capacity and cleanability.

- GE Healthcare (now Cytiva) is a leading provider of Protein A resins like MabSelect™ series, widely recognized for their scalability and robustness in commercial antibody manufacturing.

Latest Announcements:

- In April 2025, the industry-leading MabSelect protein A resin portfolio, with the launch of MabSelect SuRe 70 and MabSelect PrismA X resins, was expanded by Cytiva, a global leader in life sciences. These resins are developed to comply with growing requirements of monoclonal antibody (mAb) and biosimilar production, with novel standards in sustainability, productivity, and affordability. (Source: https://www.biospectrumasia.com)

- In October 2024, Sartobind Rapid A Lab, the latest innovation in our portfolio of laboratory separation technologies, was launched by the life science group, Sartorius (Gottingen, Germany). It features the fastest protein A matrix on the market, and this significant affinity chromatography unit is expected to transform antibody purification processes and deliver spectacular productivity. (Source: https://www.biotechniques.com)

Segments Covered in the Report

By Application

- Antibody purification

- Immunoprecipitation

By Product

- Recombinant protein A

- Natural protein A

By Matrix Type

- Agarose-based matrix

- Glass or silica gel-based matrix

- Organic polymer-based matrix

By End-user

- Pharmaceutical & Biopharmaceutical Companies

- Clinical research laboratories

- Academic research institutes

- Contract research organization

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4063

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Specialty Polystyrene Resin Market: Examine innovations in lightweight and high-performance materials reshaping industrial and consumer product manufacturing.

➡️ Protein Purification and Isolation Market: Understand the growing role of advanced purification technologies in biopharmaceutical and research applications.

➡️ Medical Polymer Market: Discover how biocompatible polymers are transforming modern healthcare devices and drug delivery systems.

➡️ Protein Ingredients Market: See how rising health consciousness and plant-based diets are boosting global protein ingredient adoption.

➡️ Dimethylformamide Market: Analyze industrial demand trends for this key solvent in chemical synthesis and textile applications.

➡️ Specialty Enzymes Market: Learn how enzyme innovations are advancing pharmaceutical, diagnostic, and bioprocessing efficiency.

➡️ PVDF Membrane Market: Explore how advanced filtration materials are enhancing performance in biotechnology and water treatment.

➡️ Life Science Chemical and Instrumentation Market: Gain insights into how R&D advancements are driving demand for analytical instruments and reagents.

➡️ Crosslinking Agents Market: Examine the importance of crosslinking technology in improving durability and stability across materials.

➡️ Checkpoint Inhibitor Biologics CDMO Market: Track how CDMOs are accelerating biologics manufacturing for advanced cancer immunotherapies.

➡️ Medical Adhesives Market: Discover how innovation in adhesive formulations is enhancing wound care, medical device assembly, and patient safety.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.